how to check unemployment tax refund amount

The letters go out within 30 days of a correction. File your current year personal state income taxes online.

Irs Unemployment Refund Update How To Track And Check Its State As Usa

This is the fourth round of refunds related to the unemployment compensation.

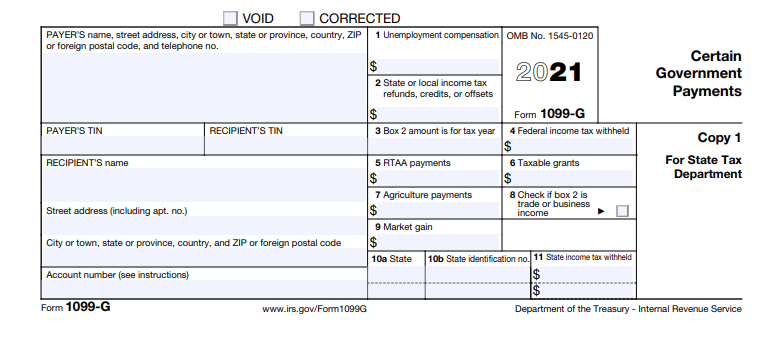

. On Form 1099-G. Viewing your tax records online is a quick way to determine if the IRS processed your refund. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form.

In Box 4 you will see the amount of federal income tax that was withheld. The systems are updated once every 24 hours. Viewing your IRS account.

You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160. Income Tax Refund Information. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next.

However the exclusion could result in an overpayment refund of the tax paid on the amount of excluded unemployment. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

Initial return amended return name of trust or estate trust number employer identification number name and title of fiduciary address of fiduciary number and street city. In Box 1 you will see the total amount of unemployment benefits you received. Enter the amount of tax you are sending with this return on Line 2.

File your Form 1027I Internet Individual Income Tax Extension online. Check For The Latest Updates And Resources Throughout The Tax Season. Choose the federal tax.

The IRS is expected to continue working through the tax. If you move without notifying. There is no tool to track it but you can check your tax transcript with your online account through the IRS.

Using the IRS Wheres My Refund tool. And then the first refund check including interest for the delay in processing compare this with your tax return followed by the second refund. File your Form 200-ESI Internet Declaration.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. If this amount is different from Line 1 indicate the tax period that you are adjusting in the space provided below Line 2 and.

The IRS has sent 87 million unemployment compensation refunds so far. To report unemployment compensation on your 2021 tax return. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

Check For the Latest Updates and Resources Throughout The Tax Season.

Irs Issues More Tax Refunds Relating To Jobless Benefits

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Automatic Refunds Coming For 10 200 Unemployment Tax Break

Accessing Your 1099 G Sc Department Of Employment And Workforce

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

File For Unemployment In Arkansas In 2020 You Could Get A Refund Thv11 Com

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Are Unemployment Benefits Taxable Wcnc Com

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring Tax Policy Center

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

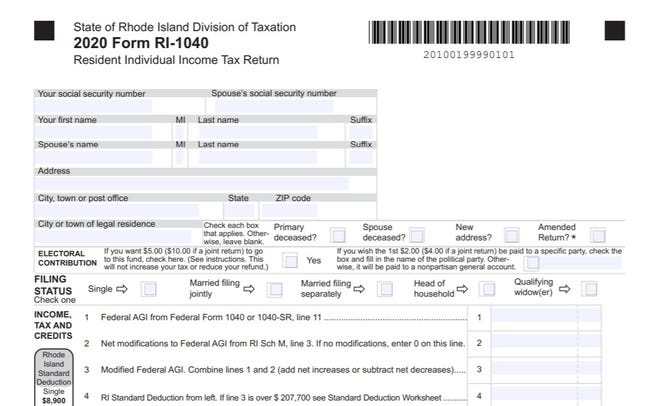

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Questions About The Unemployment Tax Refund R Irs

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits